Budget management can be a challenging task, especially in the fast-paced lifestyle we often lead in the United States. However, with the development of innovative apps, keeping track of your finances has never been easier or more efficient.

Finding the best apps for budget management can assist you in saving money, planning future expenses, and understanding your spending habits better. Let’s explore some of the top applications available to Americans for handling their finances effectively.

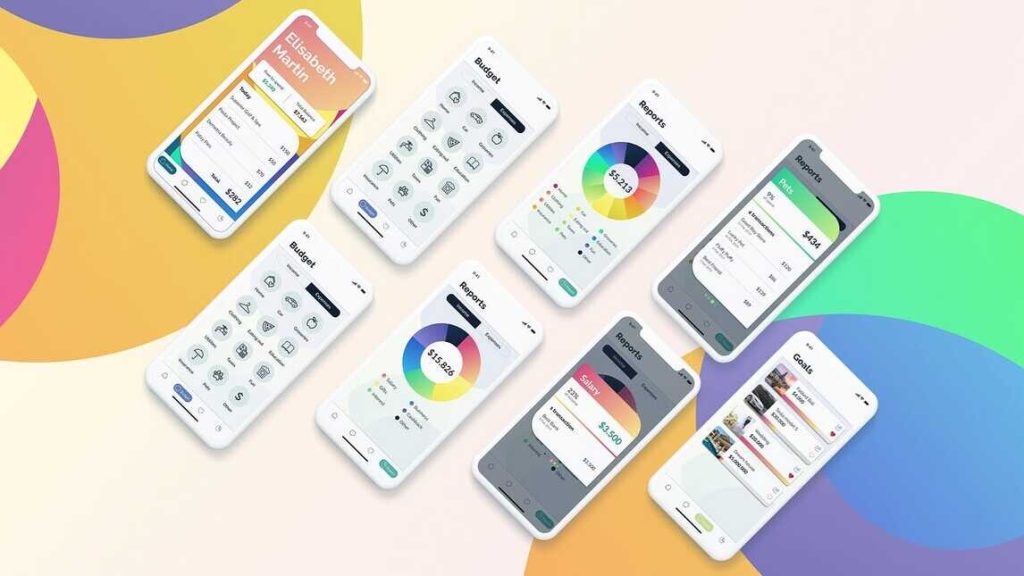

Top budgeting apps for personal finances

The focus on personal finance has led to the creation of several outstanding apps that cater specifically to budget management. One of the most popular among these is Mint. Mint offers a comprehensive dashboard that connects to your bank accounts, credit cards, and bills, giving you a complete overview of your financial situation.

It automatically categorizes your transactions, alerts you to unusual charges, and even provides personalized budget recommendations. An app mentioned frequently in budget management discussions is YNAB (You Need a Budget). YNAB focuses on proactive budgeting, encouraging users to plan their spending and allocate money for specific purposes.

This approach helps in managing finances more consciously, and its user-friendly interface makes it suitable for those new to budgeting as well as seasoned users. It syncs seamlessly across multiple devices, allowing you to update your budget on the go.

Mint: comprehensive and user-friendly

Mint, available for both Android and iOS, is user-friendly and caters to a wide audience. One of its standout features is its ability to connect to various financial institutions, giving users a real-time conceptualization of their finances. It includes bill reminders, investment tracking, and a free credit score feature, making it a robust tool for any budget management needs.

Its automatic transaction categorization saves users time and effort, allowing for easy monitoring of where their money is going. Recommendations based on spending habits can help adjust the monthly budget to save more effectively, and the application provides useful financial tips to enhance money management skills.

YNAB: proactive planning for better control

YNAB stands out because of its proactive approach, which involves users budgeting every dollar they earn, so they understand exactly where their money is going. This technique promotes mindful spending and planning for future expenses, which is beneficial for long-term financial health.

Beyond the app, YNAB has educational resources, including workshops and tutorials, to help users get the most out of their budgeting techniques. This makes it an excellent choice for those who want to not only manage their current finances but also improve their financial literacy.

Unique features of popular finance apps

Many of the best budgeting apps offer unique features that cater to specific financial needs. Expensify, for example, is an excellent app for those who need to manage expense reports and receipts efficiently. It’s particularly useful for business travelers who need to keep track of receipts for reimbursement.

Goodbudget, based on the envelope budgeting system, allows users to allocate money to different categories ahead of time. This traditional method, combined with modern technology, ensures effective allocation and spending control. It’s a great choice for those who want a simple yet effective way to manage their household budget.

Expensify: perfect for business and travel

Expensify is the go-to app for professionals who need to track expenses meticulously. It allows users to scan receipts, log miles for business trips, and create detailed expense reports seamlessly. The app’s SmartScan technology extracts details from receipts and categorizes them automatically, saving time and reducing errors. The integration with various accounting software enhances its utility for businesses of all sizes.

Additionally, Expensify offers features such as approval workflows, corporate card reconciliation, and automatic currency conversion, making it incredibly versatile. For individuals who travel frequently for work, Expensify simplifies tracking per diem expenses and adhering to budget limits. Its ease of use and comprehensive features make it indispensable for corporate expense management.

Goodbudget: simple and effective

Goodbudget adheres to the envelope system, where users allocate funds to various categories ahead of time. This helps in visualizing and adhering to budget limits for different expense categories like groceries, entertainment, and savings prematurely.

The app’s interface is straightforward, allowing users to split transactions, set goals, and monitor their progress. Goodbudget is particularly user-friendly, making it an ideal choice for families or individuals who prefer a simple, straightforward budgeting tool.

Furthermore, Goodbudget’s ability to sync across multiple devices allows all family members to stay updated on the household budget, facilitating better financial communication and planning within the family unit.

Budget management does not have to be a stressful task thanks to these innovative apps. By leveraging these tools, you can take control of your financial future and make smarter money decisions seamlessly. Choose the one that fits your needs and start your journey towards financial health today!